tax abatement definition for dummies

A tax abatement is a reduction in property taxes for a specific period of time. Tax abatement n Steuernachlass m.

Again there are the two different tax abatements to take into consideration.

. The savings in that case results from the difference in the taxability or valuation of the lease. A sales tax holiday is another instance of tax abatement. You may qualify for relief from penalties if you made an effort to comply with the requirements of the law but were unable to meet your tax obligations due to circumstances beyond your control.

Tax abatement involves real estate properties while tax penalty abatement involves a taxpayer asking the IRS for a reduction or elimination of tax penalties for late tax payments or incorrect amount of taxes paid. Abatement Definition You may wonder just what the one-time Tax Penalty Abatement program entails. Tax Increment Financing aka Tax Allocation Districts Tax Increment Reinvestment Zones etc.

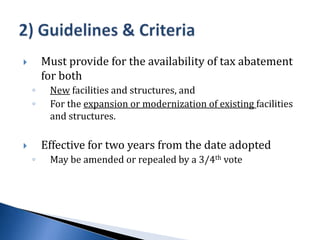

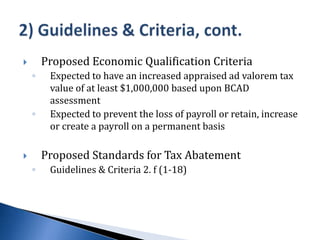

4 As such abatements should be used sparingly 5 Questionable Assessment of Blight. Definition of Abatement Property tax abatements as defined in this guide have three elements. Governments sometimes introduce it to encourage economic development.

What Is an Abatement Cost. ABATEMENT OF RENT The reduction or abatement of rent owed to a landlord as a result of a. A reduction in the amount of tax that a business would normally have to pay in a particular.

Define Abatement or Tax Abatement. For example if one receives a tax credit for purchasing a house one receives tax abatement because one pays less in taxes than heshe otherwise would. Economic development or redevelopment generally speaking and.

Definition of tax abatement. An action brought for. Calling this tax abatement means that for example a.

IRS Definition of IRS Penalty Abatement. A primary goal of tax management is to avoid wide fluctuations in annual income in order to avoid swings in marginal tax rates. If the project is majority owned by a not-for-profit it will be eligible for an as-of-right full 420c tax abatement.

An abatement may occur after a natural disaster such as a devastating earthquake flood or hurricane. Farmers who use cash-basis accounting can manage their tax liability by shifting income away from the high-income years. Search Within Application for tax abatement Definitions.

An amount by which a tax is reduced. Balloon which would cost 3500000 to extend. FEDERAL TAXES Taxes that are owed and paid pursuant to the Internal Revenue Code and in addition.

Applied to property tax savings resulting in practice when a local authority leases a project to a company. A tax abatement is a financial incentive that eliminates or significantly reduces the amount of taxes that an owner pays on a piece of residential or commercial property. More from HR Block.

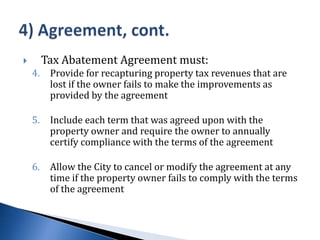

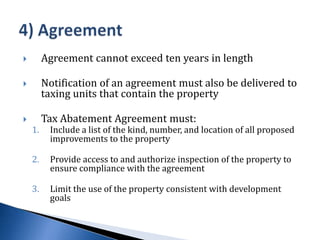

Means a full or partial exemption from City of Fort Worth ad valorem taxes on eligible real and personal property located in a NEZ for a specified period on the difference between i the amount of increase in the appraised value as reflected on the certified tax roll of the appropriate county appraisal district resulting from improvements begun after. United States Tax Compliance Certificate. It is offered by entities that impose taxes on property owners.

Low- to middle-income residents are usually the target demographic for these programs. If it is majority owned by a for-profit it will most likely utilize a 25-year 421a tax abatement. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

2 A purpose that goes beyond tax relief alone ie. What Is a Tax Abatement. A Property Tax Abatement is essentially an agreement by the city to charge the property owner less in property tax than the owner would otherwise pay without the abatement.

Tax abatement synonyms tax abatement pronunciation tax abatement translation English dictionary definition of tax abatement. ABATEMENT I A A reduction in the amount owed under contract which is withheld by the. It is most commonly applied to condominium or co-op units but can apply to any type of real estate.

In essence this program is a reprieve that allows you to escape the penalties levied against you because of not filing or failing to pay your taxes. Related Legal Terms Definitions. Also known as a tax holiday it is the temporary elimination or reduction of tax.

It involves the application of a credit to the total taxes owed. An abatement cost is a cost borne by firms when they are required to remove andor reduce undesirable nuisances or negative byproducts created during production. An abatement is a departure from equitable tax principles in which everyone pays his or her equal share of property tax.

Penalty abatement removal is available for certain penalties under certain circumstances. REDUCTION In Scotch law. A reduction of taxes for a certain period or in exchange for conducting a certain task.

Abatements can last anywhere from just a few months to multiple years at a time. 1 A reduction in property tax liability for selected parcels. TIF allows local governments to invest in infrastructure and other improvements and pay for them by capturing the increase in property taxes and in some states other types of incremental taxes generated by the development.

Property Tax Abatements generally have a finite life offering the owner the benefit for only a specific period of time after which the owner is responsible to pay the full property tax amount.

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

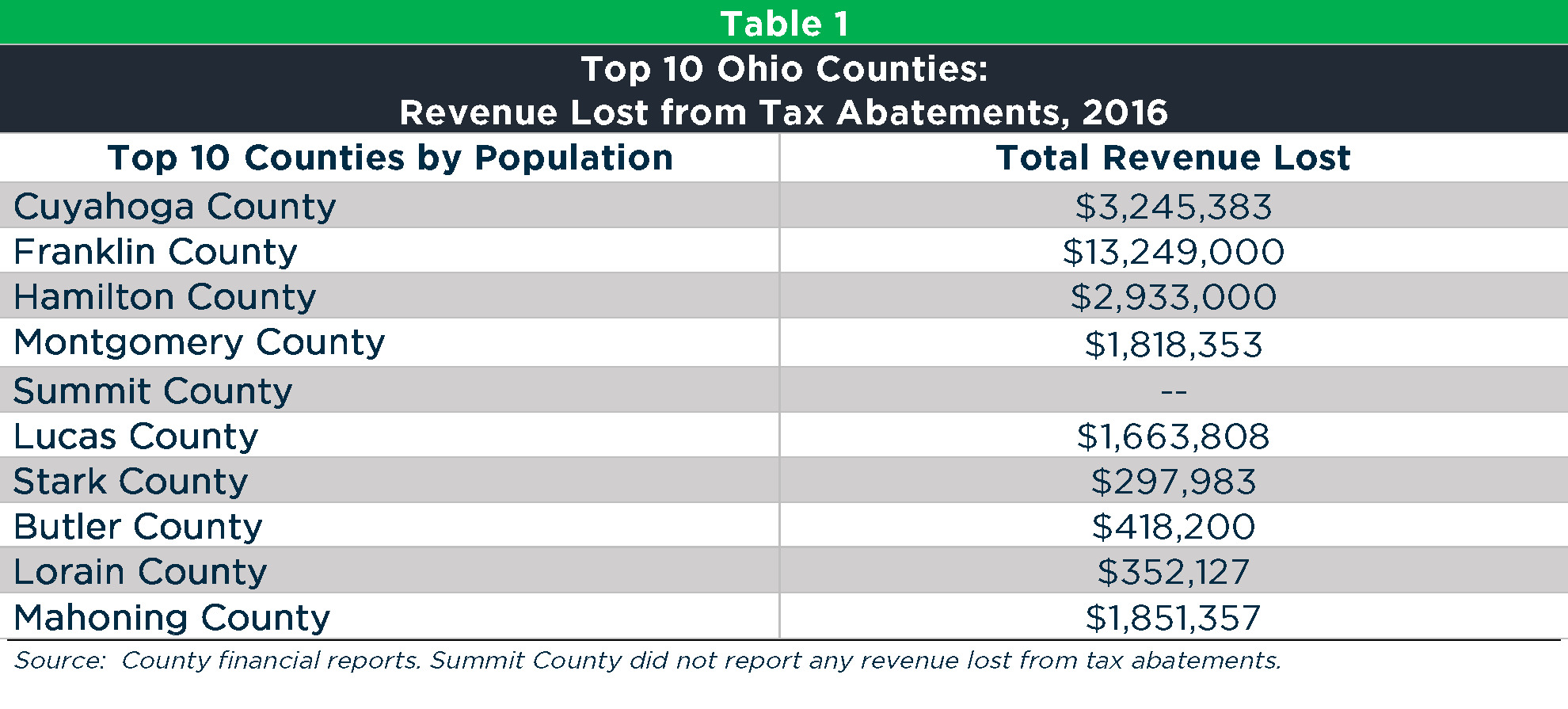

Local Tax Abatement In Ohio A Flash Of Transparency

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

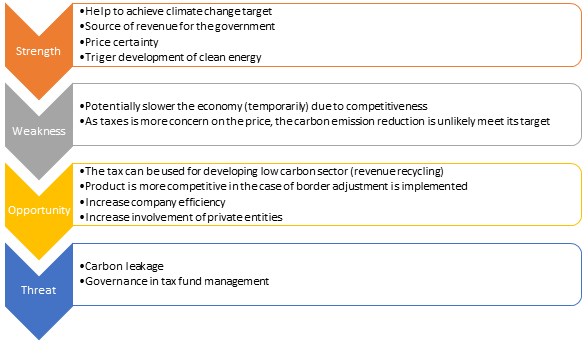

Carbon Tax Implementation In Indonesia The Purnomo Yusgiantoro Center

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Carbon Tax Implementation In Indonesia The Purnomo Yusgiantoro Center

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Local Tax Abatement In Ohio A Flash Of Transparency

Carbon Tax Implementation In Indonesia The Purnomo Yusgiantoro Center

West Midtown S Interlock Project Could Claim Another 5 4m In Tax Abatement Eco Architecture Urban Design Concept Urban Concept