virginia estate tax exemption

Pursuant to the authority granted in Article X Section 6 a6 of the Constitution of Virginia to exempt property from taxation by classification the following classes of real and personal property shall be exempt from taxation. There is a federal estate tax and many states levy their own estate taxes.

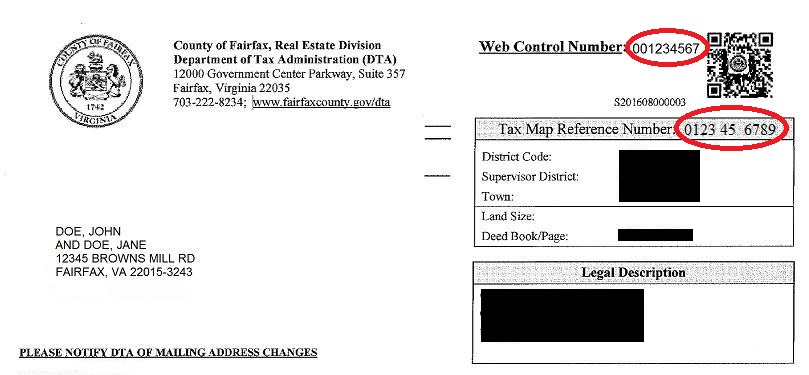

Real Estate Tax Frequently Asked Questions Tax Administration

Property passing by the exercise of a power of appointment.

. Glenn Youngkin signed a bill into law today that creates a property tax exemption for residential and mixed-use solar energy systems up to 25 kilowatts. The relief depends on the total gross income ie. The taxes and fees imposed by 581-801 581-802 581-807 581-808 and 581-814 shall not apply to i any deed of gift conveying real estate or any interest therein to The Nature Conservancy or ii any lease of real property or any interest therein to The Nature Conservancy where such deed of gift or lease of real estate is intended to be used exclusively for the.

The Code of Virginia Title 581 Chapter 36 outlines property. A similar exemption was unnecessary for other types of remainder interests because such interests are not generally subject to the federal estate tax and. Property owned directly or indirectly by the Commonwealth or any political subdivision thereof.

Senior and Disabled Real Estate Tax Relief. Virginia currently does not have an independent estate tax that is lower than the federal exemption. The tax does not apply to the following types of property within an estate.

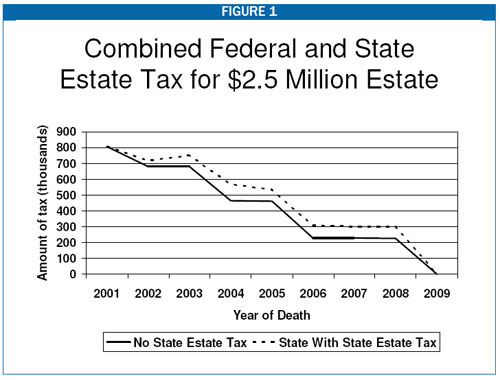

Senior citizens and. For Virginians who died prior to mid-2007 Virginias state estate taxes began at about 8 percent on estates over 2 million and rose to about 16 percent for estates over 10 million. With the elimination of the federal credit the Virginia estate tax was effectively repealed.

Under the Virginia exemption system homeowners can exempt up to 25000 of equity in a home or other property covered by the homestead exemption. With his signature today Governor. Insurance proceeds payable to a named beneficiary other than the estate.

Each filer who is age 65 or over by January 1 may claim an additional exemption. The Virginia Homestead Exemption Amount. Important Information Regarding Property Tax Relief for Seniors in Virginia.

Jointly held property with right of survivorship. Each filer who is considered blind for federal income tax purposes may claim an. In addition Virginia allows an exemption of 800 for each of the following.

No tax is imposed on estates valued at 15000 or less. Pursuant to subsection 6 a 6 of Article X of the Constitution of Virginia on and after January 1 2003 any county city or town may by designation or classification exempt from real or personal property taxes or. Sales of gold silver or platinum bullion or legal tender coins are exempt from sales tax when the total price is greater than 1000.

Applicants qualify for 100 relief if their gross income is less than 52000. However certain remainder interests are still subject to the inheritance tax. Property Exempt by State Law.

When a married couple uses the Spouse Tax Adjustment each spouse must claim his or her own age exemption. Age 65 or over. Prior to July 1 2007 Virginia had an estate tax that was equal to the federal credit for state death taxes.

Veterans of the United States Armed Forces or the Virginia National Guard who the US. Department of Veterans Affairs or its successor agency pursuant to. Each coin or piece of gold silver or platinum does not have to individually cost more than 1000.

You are not eligible for this tax exemption if you have remarried. Department of Veterans Affairs or its successor agency pursuant to. Virginia Property Tax relief for Seniors and DisabledCitizens who are over 65 permanently disabled and meet the income and asset eligibility criteria qualify for this type of exemption.

Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from taxation the real property including the joint real property of husband and wife of any veteran who has been rated by the US. The exemption applies to real property which includes your home or condominium and personal property used as a residence so your mobile home would also be. This exemption was designed to prevent both the Virginia estate tax and the postponed inheritance tax from being imposed on remainder interests that were coupled with a general power of appointment.

For a list of exemptions from the Forest Products Tax please refer to Va. The federal estate tax exemption is 5450000 for decedents dying in 2016. Commissioner of the Revenue Taxpayer Assistance.

By Kelsey Misbrener April 12 2022. While other local jurisdictions have an exemption that is lower Virginia does not. Property exempt from taxation by classification or designation by ordinance adopted by local governing body on or after January 1 2003.

To register for the Forest Products Tax a Business Registration Application Form R-1 must be filed with Virginia Tax. The exemption is based on the total purchase price for the entire transaction. Department of Veteran Affairs determined have a 100 service-connected permanent and total disability are eligible for a sales and use tax exemption on the purchase of a vehicle owned and used primarily by or for the qualifying veteran.

SB 686 expands energy freedom for consumers and creates an additional incentive to do business in the Commonwealth. Pursuant to subdivision a of Section 6-A of Article X of the Constitution of Virginia and for tax years beginning on or after January 1 2011 the General Assembly hereby exempts from taxation the real property including the joint real property of married individuals of any veteran who has been rated by the US. Property becomes taxable immediately upon sale by tax-exempt owner 581-3602 Exemptions not applicable to associations etc paying death etc benefits 581-3603 Exemptions not applicable when building is source of revenue 581-3604 Tax exemption information 581-3605 Triennial application for exemption.

Removal by local governing body 581-36051. If you are a surviving spouse of a First Responder who has been killed in the Line of Duty your principal residence may be eligible for an exemption of your real estate taxes on your home and up to one acre in Virginia. Today Virginia no longer has an estate tax or inheritance tax.

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

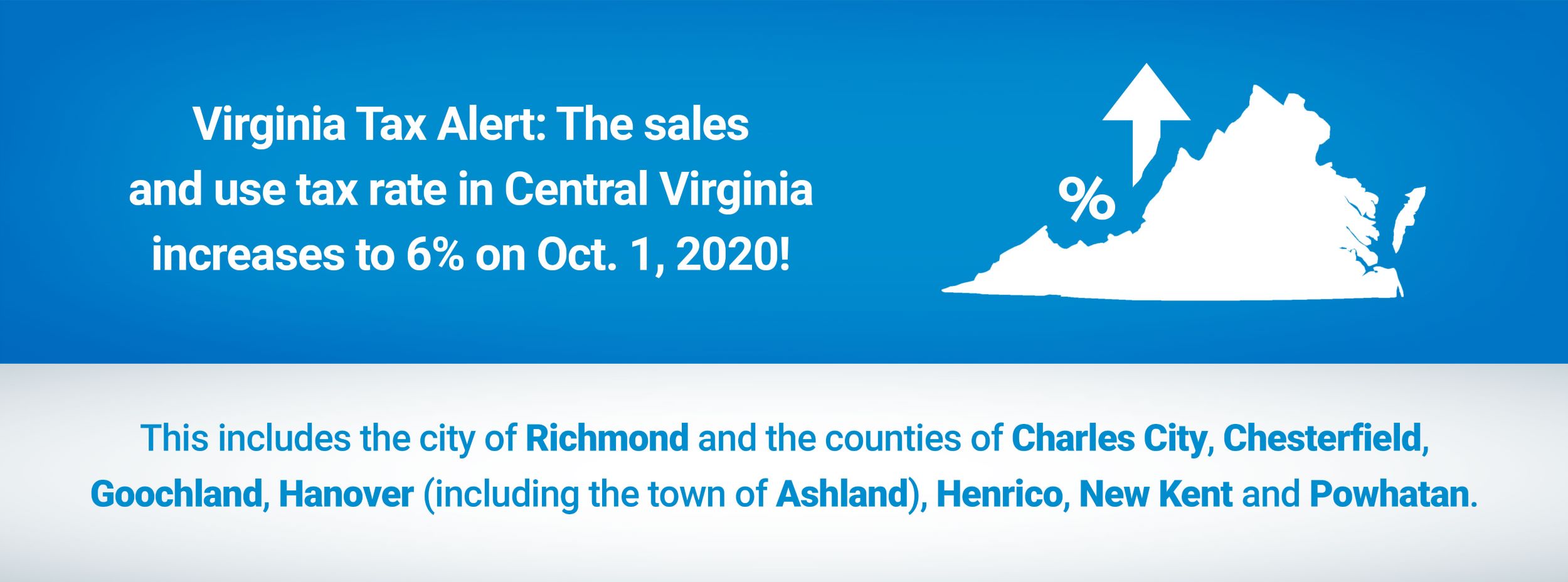

Sales Tax Increase In Central Virginia Region Beginning Oct 1 2020 Virginia Tax

How To Avoid Estate Taxes With A Trust

How To Reduce Virginia Income Tax

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Virginia Estate Tax Lawyers Federal Inheritance Taxes

Filing Virginia State Tax What To Know Credit Karma

Virginia Retirement Tax Friendliness Smartasset

How To Avoid Estate Taxes With A Trust

Assessing The Impact Of State Estate Taxes Revised 12 19 06

Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

How Your Estate Is Taxed Or Not

West Virginia Estate Tax Everything You Need To Know Smartasset

Virginia Sales Tax Exemptions Virginia Nonprofit Cpa